Target Acquired

A look into exercising employee stock options

One of the best parts about working at early-stage tech startups is the chance to earn equity that may have immense value.

Even lower-level employees can make millions from their equity simply because they worked for one of the big winners. Think Facebook, Uber & Airbnb type companies.

I don’t have a crazy story like that (yet?), but over the last 10 years, I’ve earned a small slice of the pie at each org I’ve worked for. A couple of them are close to an exit and I wanted to share what’s been going on.

Let’s start with the fun one. When I joined FloQast in 2017, they’d just raised their Series B for $25M.

I knew nothing about accounting or startup equity at the time. But I’m lucky that the leadership made an effort to educate its employees, something I’m quite grateful for.

Since I joined as an entry-level sales rep, I was at the bottom of the totem pole. My grant was for 5,000 options at $0.74/sh, vested over 4 years with a 1-year cliff.

That meant I could earn the right to purchase those shares at one month at a time over 4 years (5,000 shares / 48 months = ~104 sh / month). The cliff means I only earn options once I’ve been with the company for a full calendar year.

I was at FloQast for exactly 3 years when I left in August of 2020 so I had the opportunity to purchase 3,750 shares (75% of 5,000), which cost me a total of $2,775.

If the company tanks, I’m out that cash so it’s a risky move. Fortunately for this guy, FloQast has continued its growth. They raised their series E round for $100M in April 2024, bringing their evaluation to $1.6B and officially a unicorn.

Some investors are anxious to get in on FloQast before the IPO so I could sell those shares today on a private marketplace. On Hiive Marketplace, the best I could get is around $9/sh, or a total of $33,750. The most I’ve seen FQ shares sold for was $14/sh, a total of $52,500.

Not bad of an investment of $2,775 in 2020. But since I’m not desperate for cash, it makes sense to hold until after the IPO. If investors are hoping to get a hold of shares at $9, they must have a good feeling it’ll turn into $20, $30, or even more long-term.

FloQast’s primary competitor is publicly trading at $52/sh and peaked at almost $150 in 2021.

Back in 2017, we all thought FloQast would IPO by 2024, but the bar has been raised for SaaS IPOs. $100M in annual recurring revenue (ARR) was the old benchmark. Now it’s much higher.

Jason Lemkin, Founder of SaaStr, has a great article about the 3 last SaaS companies to IPO (as of Q3 2024 anyway).

#1. Klaviyo, Now at Almost $1B ARR, IPO’d in September 2023. Bootstrapped First 3 Years, Lightly Funded Until Growth Stage

#2. Rubrik IPO’d at $780,000,000 in ARR in April 2024. Traditionally VC Funded.

#3. OneStream, IPO’d at $480,000,000 in ARR in July 2024. Bootstrapped to $100m ARR!

His point here is that SaaS companies don’t need to raise VC funding for each phase of their growth. Klaviyo & OneStream were bootstrapped for their early stages and because of that, became attractive to investors as they expanded and eventually went public.

Now the not-so-fun one. Another fintech startup I joined was Airbase, which was recently acquired by Paylocity.

I joined Airbase a year after they raised a Series A extension for $23.5M. During the interview process, I was told by the VP of Sales that my shares would be priced at about $0.56/sh.

I’m super stoked about this because the B2B payments space is growing and is a very sticky product. Once you roll out a payment tool to the whole org, you really won’t want to rip and replace it. I felt like I’d found another winning SaaS company at just the right time so the equity wasn’t expensive.

Well, just one month after my start date, Airbase raised a $60M Series B in just 10 days.

And because of one pesky phrase in my offer letter, this made a huge difference for me.

“The Company’s Plan is pending adoption and approval by the Company’s Board of Directors and Shareholders, and therefore, no option can be granted until such approvals have been obtained.”

In other words, the Board needs to meet and approve option grants for new employees, which hadn’t happened for me before the Series B was raised at the new valuation of $600M. So my $0.56/sh turned into $3.20/sh - womp womp.

There really isn’t much to do at that point. I asked for more shares given the situation, but they wouldn’t entertain that idea. And it’s not like I’m going to quit a job I just started after I’d already left my old one. Ultimately, it became a lesson learned and a bit of foreshadowing for how the org operated overall.

Anyways, fast-forward 18 months to October 2022 and I’ve left Airbase. That means the clock for when I can exercise my options officially starts. Unlike most equity grants, the amount of time I had to exercise was equal to how long I’d been at Airbase so I waited another 18 months to do that (most companies give you 90 days to exercise, regardless of how long you’d been there).

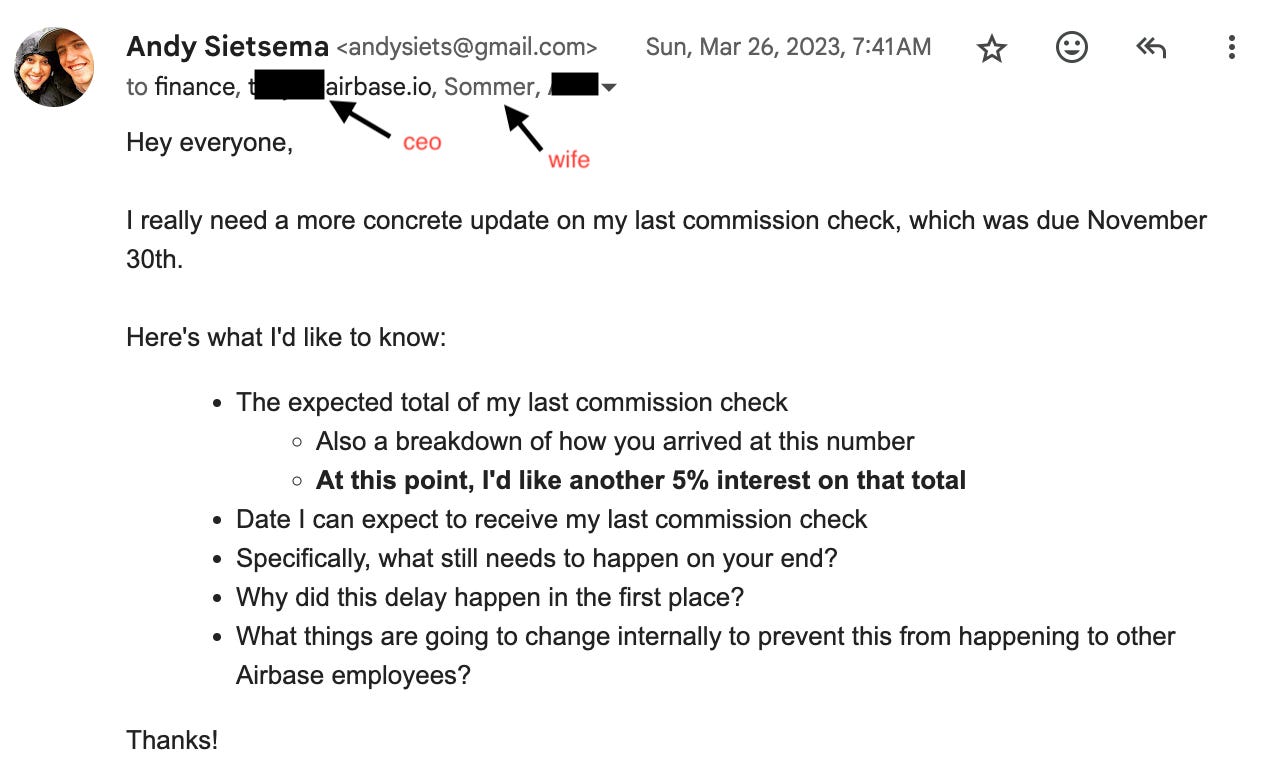

Sorry, but I have a random side note here on the few months after leaving Airbase. I had an email chain that was 50+ messages long going back and forth with Accounting and HR about receiving my last commission check.

It wasn’t even an argument, it was just waiting for approvals and just doing the thing of sending me the money. Which is literally what the Airbase product does for businesses. Pretty hilarious.

At first, I was genuinely curious how long it’d take to do what was legally their duty, but that got old. Eventually, I cc’d the CEO on my reply and I was paid within a week.

Despite the annoying chore of needing to become a squeaky wheel so I could collect the money I’d earned, I was still a fan of the business.

The troubling part of it all was that Airbase had an FMV (fair market value) of just ~$1.90/sh. So in order to exercise, I’d need to pay an 88% markup. The reason the value had dipped is because Airbase took a $150M Credit Facility from Goldman Sachs in July 2022.

Part of Airbase’s business model is extending credit to its customers to make purchases. But it doesn’t make sense to use funding dollars so customers could make purchases - that cash should be for improving the product and winning new business.

All that being said, I still chose to exercise my equity in February of 2024. I thought they’d raise more cash later on at a higher valuation and have an exit 4-7 years into the future. Poop.

But the same year I exercised, Airbase was purchased for $325M by Paylocity, almost half of what it was valued at after the series B ($600M).

What does that mean for me? All I could do was ask the fine folks at Airbase myself.

¯\_(ツ)_/¯

Stay tuned and I’ll share an update on this.

But to any startup employees reading this, I hope these examples help you understand some of the unknowns about what could happen with your equity.

And if you understand more about this than I do or have an interesting startup equity story, let me know. I would love to learn more and hear about it.

&E